These are my definition related comments from the previous post:

As noted previously, "deflation" is often discussed in broader terms than simply price level:Some Relevant Current ArticlesThe various measures are often somewhat correlated but they only track to each other loosely. In the Great Depression prices fell faster than wages, yet wages (along with asset prices) still fell enough to propagate the adverse feedback loop of debt deflation in which income falls but debt obligations remain at the same nominal level, increasing the burden of the debt. Deflation in asset prices (triggered by the bursting of debt-financed asset bubbles) generally precedes the other deflationary trends.

- Contraction of money and credit (broad money supply)

- Deflation in asset prices

- Deflation in a representative "basket" of consumer and producer prices

- Deflation in wages

In BLS Owner's Equivalent Rent Numbers From Twilight Zone, Mish looks at the surprisingly small decline so far in rent and owners-equivalent-rent measures:

"With home prices crashing year-over-year and both housing rents and apartment rents dropping as well one might think that falling rents would be reflected in the CPI."Mish subsequently looks at the September CPI data in Year-Over-Year CPI Negative 7th Consecutive Month; Rents Decline First Time In 17 Years.

While many have expected falling rents and their eventual impact on reported CPI, Calculated Risk has been bringing the topic up more recently, for example, here:

"Anyone analyzing the tax credit should call the economists at the BLS and ask about how falling rents will impact owners' equivalent rent and CPI. Then call the economists at the Federal Reserve and ask how CPI deflation will impact consumer behavior and monetary policy. Welcome to the Fed's nightmare."The BLS methodology for calculating owners' equivalent rent (weighted at 23.8% of the entire CPI!) is to survey homeowner households. Given people's likely lack of close knowledge of the current rental market, lack of objective perspective of their own home's rental value, and lag effects of changing home prices, rents and perceptions, it is no wonder that the BLS measure has not fallen at the rate anecdotal experience suggests it should have. The BLS says on its guide to Consumer Price Indexes for Rent and Rental Equivalence:

"However, the expenditure weight in the CPI for rental equivalence is obtained by directly asking sampled owner households the following question: If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?"In China’s September data suggest that the long-term overcapacity problem is only intensifying, China expert Michael Pettis discusses (among other topics) the level of China's commodity imports. He quotes someone else regarding China: "the recent pace of commodity import growth has been much faster than justified by the rise in current demand." Pettis then says:

"It seems that there may be another explanation, and that is stockpiling by private investors. From what I am being told, it seems that a number of wealthy Chinese investors have been speculating directly in commodities, and so some of this inventory buildup is occurring not at the company level but at the investor level."The potential for a sharp drop in commodity imports by China (if this inventory build is accurate and if it turns out to not be sustainable and if real demand doesn't catch up quickly) is one of the reasons, even if the odds could be small, that I believe there could at some point be another commodity price "crash" similar to the second half of 2008. Those are a lot of "if"s, and they are not the only factors involved. But if commodity prices crashed in the context of other CPI components already in mild decline (food and shelter in particular have moved in this direction recently), then unlike in 2008 in which inflation in many CPI components was still high, the conditions would be more similar to the starting conditions of the self-reinforcing deflationary spiral during the Great Depression. To recap the 1930s experience, look at the Great Depression CPI Components chart later in this post (and past posts) — in 1929, before CPI started dropping rapidly, only food prices were in a rising trend — everything else was already declining.

In The September CPI with all the trimmings, Macroblog at the Federal Reserve Bank of Atlanta discusses whether the recent CPI changes really show "broad based" increases, and concludes:

"An interpretation of these data is that the September CPI increase was anything but broad-based. Moreover, the data seem consistent with the idea that prices overall are on a path of disinflation."I'll start including a trimmed CPI chart with the others (below).

Price Level Charts for September

CPI-U 12 Month Changes, 1999 to Present (US) (source)

(click on chart for a larger version in a new window)

BLS Summary Comments:

"On a seasonally adjusted basis, the Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in September, the Bureau of Labor Statistics reported today. The increase was less than the 0.4 percent rise in August. The index has decreased 1.3 percent over the last 12 months on a not seasonally adjusted basis.16% Trimmed CPI

The seasonally adjusted increase in the all items index was broad based, although tempered by a decline in the food index. The all items less food and energy index increased 0.2 percent in September after increasing 0.1 percent in each of the previous two months. Contributing to this increase were advances in the indexes for lodging away from home, medical care, new vehicles, used cars and trucks, and public transportation. The increase occurred despite declines in the indexes for rent and owners’ equivalent rent, the first decreases in those indexes since 1992. The energy index also increased in September, as increases in the indexes for gasoline, fuel oil and electricity more than offset a decline in the index for natural gas.

In contrast to these increases, the food index declined, falling for the sixth time in the last eight months. The index for food away from home increased, but the food at home index declined as the indexes for fruits and vegetables and for meats, poultry, fish and eggs fell sharply. Both the food and energy indexes have declined over the past 12 months. The decline in the food index is the first 12-month decrease in that index in over 40 years."

This chart of 16% trimmed mean CPI (generated from the Cleveland Fed site) removes the most extreme monthly price changes, and it shows a rapid disinflation in progress (with the year over year rate of increase down to 1% so far, versus 1.5% for the core CPI), though the rate has recently slowed:

Consumer Price Index Trends: Great Depression versus Today through September 2009 (US)

Components of US Consumer Price Index (May 1927 - Dec 1937, Great Depression)

Components of US Consumer Price Index (Jan 2006 - Sep 2009)

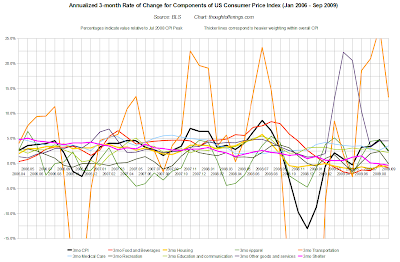

Annualized 3-Month Rate of Change for Components of US Consumer Price Index (Apr 2006 - Sep 2009)

The annualized 3-month rate of change chart is new for this month. Despite being cluttered with too many lines (sorry), it does give a better sense for the rate of change of the components whose absolute price levels are shown in the previous chart. Most components are flat or down as of the three month last period. I also added the magenta line for shelter (even though it is contained within the yellow housing measure) to better show the effect of declining rents and owners' equivalent rents separated from other housing components such as energy. Shelter has been in a remarkably consistent disinflation and has just turned negative.

Price Index Changes: Great Depression CPI versus Current PPI through September 2009 (US)

Consumer Price Index Trends: 1990s Japan versus US Today (through September 2009) and US Great Depression

CPI in Japan (Jan 1980 - Jul 2009)

The peak of Japan's CPI occurred in October 1998, almost eight years after the stock market peaked, and Japan's notorious mild deflation has been in effect since then. A multi-year disinflation (of core CPI) leading to sustained mild deflation is one possible outcome for the US.

Factors Contributing to Deflation

This is a partial selection of measurable forces that contribute toward price deflation, though the core cause is the bursting of debt-financed asset price bubbles. Not all of these measures are in an outright deflationary trend, but most are suggesting at least disinflation. This data is US-specific, but US price levels will also be affected by global trends in the months and years ahead, for example with respect to whether China and other emerging economies falter meaningfully in their growth. I have kept the same set of charts even though same data updates are quarterly not monthly and as such some charts are the same as last time. No commentary on these for now — perhaps in the future.

Capacity Utilization (through Sep 2009)

Inventory to Sales Ratio (through Aug 2009)

(click on chart for a larger version in a new window)

Gross Domestic Purchases (through Q2 2009)

Total Consumer Credit (through Aug 2009)

(click on chart for a larger version in a new window)

Total Bank Credit (through Oct 7th 2009)

(click on chart for a larger version in a new window)

Total Borrowing (All Debt Markets) (through Q2 2009)

(click on chart for a larger version in a new window)

(source)Broad Money Supply (through Oct 5th 2009)

(click on chart for a larger version in a new window)

Disposable Personal Income (through Aug 2009)

(click on chart for a larger version in a new window)

Employment Cost Index (through Q2 2009)

(click on chart for a larger version in a new window)

(source)

(source)Unemployment (through Aug 2009)

(source)

Household Debt Service (through Q2 2009)

(click on chart for a larger version in a new window)

Household Financial Obligations (through Q2 2009)

(click on chart for a larger version in a new window)

Household Wealth (through Q2 2009)Source: Calculated Risk

Personal Savings Rate (through Aug 2009)

(click on chart for a larger version in a new window)